Sector Update / Cement / Click here for full PDF version

Author(s): Jovent Muliadi ;Ryan Dimitry

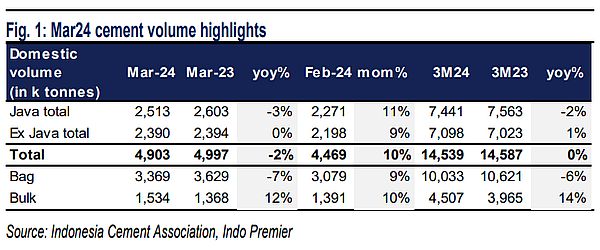

- Overall domestic volume declined by -2% yoy/+10% mom, bulk remained the driver with +12% yoy/+10% mom. Bag at -7% yoy/+9% mom.

- dropped -5% yoy/+13% mom while grew by +7% yoy/+6% mom - note that this due to inclusion of Grobogan volume YTD.

- Retail pricing has so far also been muted (mostly flat YTD). We expect demand to remain muted in Apr due to Lebaran seasonality.

Overall volume remained weak due to fasting month

Overall domestic volume declined by -2% yoy/+10% mom to 4.9mt in Mar24. Bulk continued to be the major contributor at +12% yoy/+10% mom, bag volume remained weak at -7% yoy/+9% mom due to shorter working days (two long weekends in March) along with fasting month. In terms of region, Java experienced a decline of -3% yoy/+11% mom while ex-Java was flat yoy/+9% mom (driven by Kalimantan at +19% yoy/+9% mom). Cumulatively, 3M24 volumes was flat at 14.5mt.

volume was dragged by weak Java growth

volume declined -5% yoy/+13% mom driven by volume drop in Java at -14% yoy/+14% mom while ex-Java grew +4% yoy/+12% mom. Kalimantan remained the growth driver at +34% yoy/+11% mom from demand in IKN. Bulk was growing at +4% yoy/+13% mom, but bag was weak as it dropped -8% yoy/+13% mom due to the fasting month and lesser working days. Cumulatively 1Q24 volumes reached 7.1mt or -4% yoy, still below its target of 2-3% yoy growth in FY24F.

volume growth was positive driven by bulk growth

volume grew by +7% yoy/+6% mom due to the inclusion of Grobogan volume since Jan24. Volume was driven by bulk which grew +41% yoy/+16% mom vs. bag -4% yoy/+2% mom. Bulk was driven by infrastructure projects in West Java and Greater Jakarta as well as some volume in IKN. In terms of region, Java grew by +13% yoy/+8% mom vs. ex-Java -4% yoy/+2% mom largely due to the inclusion of Grobogan. Cumulatively 1Q24 volumes reached 4.2mt +7% yoy.

Maintain Neutral as the sector is lacking catalyst but trading at attractive valuation

We believe that recent sell-off may have priced-in demand weakness, however we don't rule out the possibility of more aggressive pricing (either through fighting brand or lower main brand price) shall the weakness in demand prolong. This underpins our unchanged Neutral rating despite the attractive valuation as both stocks share price have retreated to 14 years low - a level that hasn't been seen since 2010. The sector now trades at 5.7x EV/EBITDA (vs. 11.1x 10Y average) and 50 EV/tonne (vs. c.US$120/ton replacement costs).

Sumber : IPS